What Tax Form Is Needed For 401K Withdrawal . Federal income tax can be withheld at a rate of 7%, 10%, 12%, or. learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. you may choose to have federal income tax withheld from your social security benefits. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early distributions. Find out the tax advantages and. Note you will only receive this if you.

from www.solo401k.com

learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early distributions. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or. Note you will only receive this if you. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. you may choose to have federal income tax withheld from your social security benefits. Find out the tax advantages and.

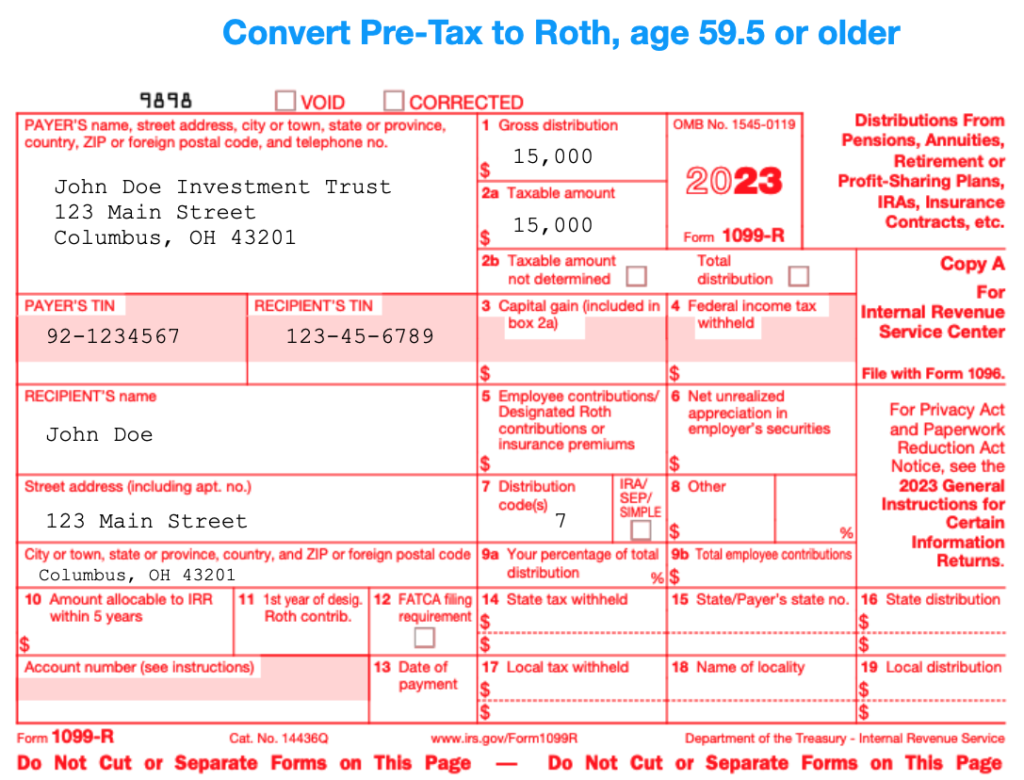

How to File IRS Form 1099R Solo 401k

What Tax Form Is Needed For 401K Withdrawal 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). Federal income tax can be withheld at a rate of 7%, 10%, 12%, or. you may choose to have federal income tax withheld from your social security benefits. Find out the tax advantages and. Note you will only receive this if you. learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early distributions. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account.

From www.pdffiller.com

401k Withdrawal Forms Fill Online, Printable, Fillable, Blank pdfFiller What Tax Form Is Needed For 401K Withdrawal Find out the tax advantages and. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or. learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding. What Tax Form Is Needed For 401K Withdrawal.

From www.dochub.com

Paychex 401k withdrawal form Fill out & sign online DocHub What Tax Form Is Needed For 401K Withdrawal Federal income tax can be withheld at a rate of 7%, 10%, 12%, or. Note you will only receive this if you. you may choose to have federal income tax withheld from your social security benefits. learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or. What Tax Form Is Needed For 401K Withdrawal.

From taxwalls.blogspot.com

Do I Get A Tax Statement For 401k Tax Walls What Tax Form Is Needed For 401K Withdrawal learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early distributions. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). you may choose to have federal income tax withheld from your social security. What Tax Form Is Needed For 401K Withdrawal.

From livewell.com

What Tax Document Do I Need For 401K LiveWell What Tax Form Is Needed For 401K Withdrawal Federal income tax can be withheld at a rate of 7%, 10%, 12%, or. you may choose to have federal income tax withheld from your social security benefits. Find out the tax advantages and. Note you will only receive this if you. learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on. What Tax Form Is Needed For 401K Withdrawal.

From www.annuity.org

401(k) Plans What Is a 401(k) And How Does It Work? What Tax Form Is Needed For 401K Withdrawal learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). you may choose to have federal income. What Tax Form Is Needed For 401K Withdrawal.

From www.greenbushfinancial.com

401(K) Cash Distributions Understanding The Taxes & Penalties What Tax Form Is Needed For 401K Withdrawal Find out the tax advantages and. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early distributions. learn how your 401 (k) contributions are. What Tax Form Is Needed For 401K Withdrawal.

From becomethesolution.com

How To 401k Hardship Withdrawal Step by Step What Tax Form Is Needed For 401K Withdrawal learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). Federal income tax can be withheld at a. What Tax Form Is Needed For 401K Withdrawal.

From ceqxakif.blob.core.windows.net

Tax Forms For 401K at Michael Ison blog What Tax Form Is Needed For 401K Withdrawal learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. Find out the tax advantages and. Note you will only receive this if you. learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early distributions. Federal income. What Tax Form Is Needed For 401K Withdrawal.

From exosuihhu.blob.core.windows.net

Tax Form For Withdrawal Of 401K at James Wenzel blog What Tax Form Is Needed For 401K Withdrawal learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. Find out the tax advantages and. you may choose to have federal income tax withheld from your social security benefits. 401 (k)s offer an upfront tax break or a tax break in retirement, depending. What Tax Form Is Needed For 401K Withdrawal.

From www.thebalancemoney.com

401(k) Hardship Withdrawals—Here's How They Work What Tax Form Is Needed For 401K Withdrawal 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). you may choose to have federal income tax withheld from your social security benefits. learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early. What Tax Form Is Needed For 401K Withdrawal.

From www.formsbank.com

401(K) Hardship Withdrawal Form printable pdf download What Tax Form Is Needed For 401K Withdrawal Find out the tax advantages and. learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). learn. What Tax Form Is Needed For 401K Withdrawal.

From mint.intuit.com

401k Early Withdrawal What to Know Before You Cash Out MintLife Blog What Tax Form Is Needed For 401K Withdrawal learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early distributions. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). Note you will only receive this if you. you may choose to have. What Tax Form Is Needed For 401K Withdrawal.

From exosuihhu.blob.core.windows.net

Tax Form For Withdrawal Of 401K at James Wenzel blog What Tax Form Is Needed For 401K Withdrawal Federal income tax can be withheld at a rate of 7%, 10%, 12%, or. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). you may choose to have federal income tax withheld from your social security benefits. learn how taxes. What Tax Form Is Needed For 401K Withdrawal.

From www.pdffiller.com

Fillable Online transamerica 401k withdrawal form Fax Email Print What Tax Form Is Needed For 401K Withdrawal Federal income tax can be withheld at a rate of 7%, 10%, 12%, or. learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. you may choose to have federal income tax withheld from your social security benefits. 401 (k)s offer an upfront tax. What Tax Form Is Needed For 401K Withdrawal.

From www.dochub.com

Paychex 401k withdrawal Fill out & sign online DocHub What Tax Form Is Needed For 401K Withdrawal Note you will only receive this if you. you may choose to have federal income tax withheld from your social security benefits. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or. learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early distributions. Find out the tax. What Tax Form Is Needed For 401K Withdrawal.

From www.signnow.com

Pentegra 401k Withdrawal Complete with ease airSlate SignNow What Tax Form Is Needed For 401K Withdrawal Find out the tax advantages and. learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account. you may choose to have federal income tax withheld from your social security benefits. learn how taxes work on 401 (k) contributions and withdrawals, including the 20%. What Tax Form Is Needed For 401K Withdrawal.

From dpzvtzafeco.blob.core.windows.net

Tax Form For Covid 401K Withdrawal Turbotax at Cheryl Tran blog What Tax Form Is Needed For 401K Withdrawal Note you will only receive this if you. learn how taxes work on 401 (k) contributions and withdrawals, including the 20% withholding tax on early distributions. you may choose to have federal income tax withheld from your social security benefits. Find out the tax advantages and. Federal income tax can be withheld at a rate of 7%, 10%,. What Tax Form Is Needed For 401K Withdrawal.

From www.financestrategists.com

AfterTax 401(k) Contribution Definition, Pros, Cons, & Rollover What Tax Form Is Needed For 401K Withdrawal Note you will only receive this if you. 401 (k)s offer an upfront tax break or a tax break in retirement, depending on whether you have a traditional 401 (k) or a roth 401 (k). learn how your 401 (k) contributions are taxed when you withdraw them in retirement, depending on whether you have a traditional or roth account.. What Tax Form Is Needed For 401K Withdrawal.